10 Simple Techniques For Whole Farm Revenue Protection

Wiki Article

Whole Farm Revenue Protection Can Be Fun For Everyone

Table of ContentsThe Definitive Guide for Whole Farm Revenue ProtectionWhat Does Whole Farm Revenue Protection Mean?8 Easy Facts About Whole Farm Revenue Protection ExplainedWhole Farm Revenue Protection - QuestionsThe Only Guide for Whole Farm Revenue Protection

The 6-Second Trick For Whole Farm Revenue Protection

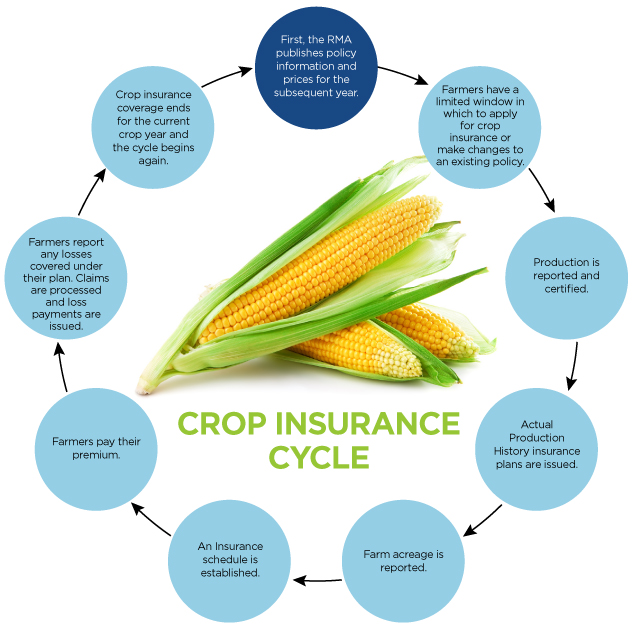

Various from the FCIP Insurance coverage policies, Plant hail storm insurance coverage is not related to the government and also is totally offered by exclusive companies that can be purchased any time during the plant cycle. Hailstorm coverage, unlike the name recommends, covers crops from threats apart from hail like fire, lightning, wind, criminal damage, etc.When participating in the contract with the insurance firms, farmers choose the volume of the yield to be guaranteed (which could be between (50-85)% depending upon requirements) along with the defense rates of the government. While MPCI utilizes the recommendation return acquired from the historical data of the farmers to determine the loss, Group-Risk-Plan (GRP) utilizes a region return index.

Given that these estimations can take time, the time of settlement upon claims can take more time than MPCI payments. Income Insurance coverage, on the various other hand, give defense against a decrement in produced income which may be a result of loss of production in addition to the modification in the market price of the crops, and even both.

The Basic Principles Of Whole Farm Revenue Protection

This kind of plan is based upon providing security if and also when the typical county earnings under insurance coverage goes down below the revenue that is picked by the cultivator. Crop insurance policies are crucial to the monetary sustainability of any farmland. Although the basic principle of agriculture insurance policy is as basic as it is necessary to understand, picking the finest kind of insurance policy that suits your details needs from a wide variety of insurance coverage can be a tough task.It's important to note that insurance coverage for dry spell may have specific constraints or needs. The plan might have particular criteria pertaining to the severity as well as period of the dry spell, as well as the influence on crop production. Farmers must carefully review their insurance plan as well as seek advice from their insurance coverage representative to recognize the level of insurance coverage for dry spell and also any kind of various other weather-related dangers.

Mark the broken area locations after a climate calamity or a condition or a parasite strike and also send records to the insurance policy.

Things about Whole Farm Revenue Protection

For an in-depth description of precise coverages, restrictions and exemptions, please refer to the policy.

Fantastic factor. And there's some various other things that should consider things like the ranch machinery as well as the tools, just how much insurance coverage you need for that? Just how much is it worth? What are some other points to take into consideration here in our last best site couple of mins, a few other points to assume concerning aside from just these leading 5? Among the things that I consider a lot is your automobiles.

On a personal car side, and also we can also do it on a business auto side also. Therefore we might play about with that a whole lot as well. Stephanie can certainly chat extra on the commercial automobile side, but we have a whole lot of tiny leisure activity farms that simply guaranteed their 1988 Ford pickup on their individual auto policy and also is simply made use of to head to the feed shop and also to go relocate some hay link for the day and also go grab some more dust.

Our Whole Farm Revenue Protection PDFs

Or if you do move it to a farm auto plan, typically on a ranch automobile policy, your responsibility will start higher. Among the reasons that we take a look at that too, and also why we write the greater restrictions is since you're not just utilizing that car or you might not just possess that automobile separately, but if you are a farmer which is your income, having something that can return to you, that you are responsible for, having those greater limitations will certainly not only secure you as as an individual, but will assist shield that farm too.There's various other pieces to take into account that might get damaged, or it could be part of your responsibility or just a core component of your company that you intend to see to it it was covered. Yeah. Some farm equipment like the tractors, they're great to be under your homeowners policy.

That can take place the property owner's plan. But when your farm machinery is made use of for greater than just keeping your building, then you truly do wish to include that kind of machinery to a farm policy or you wish visit to want to obtaining a farm policy. I have farmers that insure things from tractors to the watering devices, hay rakes, integrate, numerous various things that can be covered independently.

Report this wiki page